Collect payments anywhere, anytime

Our payment gateway helps businesses to easily collect payments with low fees and no hidden charges. You can save costs when you accept payments with Fincra.

Payment solutions for every business

Growing a business isn’t easy, but we’ve got your back. Fincra helps businesses of all sizes and types, from retail, e-commerce, marketing, hospitality, travel agencies, consulting, and service sectors, process payments quickly and securely.

For every business, every customer

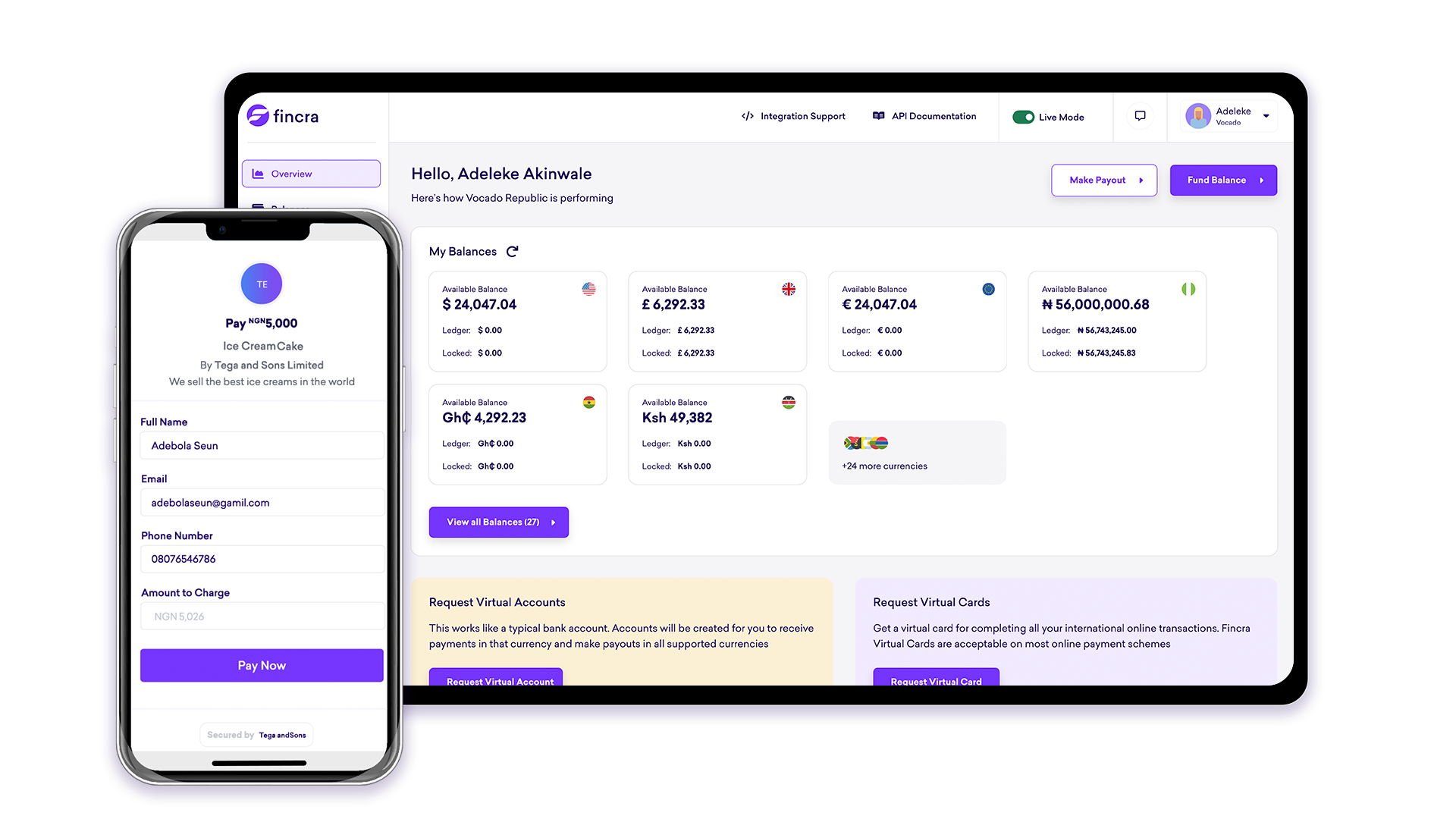

Fincra’s versatile Pay-In caters to businesses of all kinds, ensuring that your customers can pay you with their preferred methods, from Payment Links to Virtual Accounts and Checkout, to ensure complete customer satisfaction.

With Fincra, your customers can pay you with a secure payment gateway via;

- Debit/Credit Cards

- Bank Transfers

- M-Pesa

- Mobile Money

- PayAttitude

Payment gateway to global commerce

Whether you need to collect recurring subscription fees or sell one-time items, Fincra Checkout makes it easy to accept payments from anywhere in the world and in various currencies—quick and secure card payments in NGN and USD.

Sell to anyone, anywhere

Our Multicurrency Accounts enable businesses to reach global markets and collect payments in multiple currencies via Virtual Accounts without hidden charges. Receive payments in USD, GBP and EUR.

Send payments with Fincra Pay-out

- Local and International Bank Transfer

- Mobile Money Transfer

- Fincra Balance to Balance transfer

- Cash pick-ups (Coming soon)

Receive payment from anywhere on the internet

With no code required, you can create easy payment links, share the link with your customers wherever they are and collect payments online without a website. Customers can pay you via cards, bank transfers or PayAttitude.

We’ve done the heavy lifting of connecting different banks, wallets, currencies, currency conversion services & payment methods, so you can connect your financial world with one API.

Our APIs give you access to all the resources you need to carry out seamless payment activities from your app, including creating and maintaining virtual accounts in available currencies, making payouts to different beneficiaries, and receiving payments across several channels and methods.

Checkout API

Converting one currency to another is quick, easy, and seamless using Fincra.

Virtual Account API

Converting one currency to another is quick, easy, and seamless using Fincra.

Pay-Out API

Converting one currency to another is quick, easy, and seamless using Fincra.

Conversions API

Converting one currency to another is quick, easy, and seamless using Fincra.

Why Fincra?

Fincra provides payment solutions to accept payments securely, make payouts globally and scale your business across borders.

Payment infrastructure for global scale

Millions of API Requests Monthly

Our infrastructure handles millions of API requests monthly

50+ Currencies

Fincra supports transactions in USD, EUR, GBP, KES, NGN, GHS and many more

RESIDENTIAL

99.95% Uptime

Service uptime since January 2022 with month on month consistency

40+ Countries

Get paid like a local with local payment channels in more than 40 countries